![How to Start A Nonprofit 501(c)3 Org. [10 Step Guide] How to Start A Nonprofit 501(c)3 Org. [10 Step Guide]](https://www.dojiggy.com/files/sites/164/2019/03/starting-a-nonprofit-501c3-the-official-10-step-guide-1-jpg.webp)

Nonprofits start with impassioned people ready to make a difference. It only takes one passionate person to forge ahead and start a nonprofit or charitable organization. But, like any business, a lot of research and planning goes into starting a nonprofit organization. There are legal, accounting, and technical considerations as well as funding to consider.

In this blog, we’ll outline the steps to starting a 501(c)3 nonprofit organization.

What We’ll Cover:

- Benefits of 501(c)(3) Status

- 10 Steps to Start a Successful Nonprofit Organization

- 1. Choose a Meaningful Name for the New Nonprofit 501(c)3

- 2. Find an Attorney or Professional to Help (If You Have a Budget)

- 3. File Articles of Incorporation with Your State

- 4. Apply for Federal and State Tax Exemptions

- 5. Draft Nonprofit Bylaws for the New Nonprofit

- 6. Establish a Nonprofit Website and Social Media Channels

- 7. Select Your Nonprofit Board Members

- 8. Hold the First Board Meeting

- 9. Apply for Necessary Licenses and Permits

- 10. Start Fundraising

- Donors Are Key to Starting a Successful Nonprofit

- Get Your Nonprofit Funded with Free Fundraising Websites by DoJiggy

Benefits of 501(c)(3) Status

Before we jump into how to establish a charitable organization, it’s helpful to consider why individuals decide to do this. The benefits of obtaining 501(c)(3) status are significant, aiding organizations in their mission for greater impact. Some of the biggest benefits of forming a nonprofit include:

- Tax exemptions for your donors

- Eligibility for many grants and public funding

- Increased credibility and public trust among your supporters and community

10 Steps to Start a Successful Nonprofit Organization

Hard work and dedication can help you realize your dreams of helping others. But how does it all come together? Use our 10-step guide as an outline to help you successfully form and start a nonprofit 501c3 organization.

1. Choose a Meaningful Name for the New Nonprofit 501(c)3

Your name will likely stay with you as long as your nonprofit stands and is integral to creating a strong nonprofit brand. The most important consideration is how to keep your nonprofit name and brand in the minds and hearts of your future supporters.

The name of your nonprofit must be unique and memorable. It cannot be the same as another organization on file with your state’s business or corporation’s office.

Here are some tips for choosing a name for your new nonprofit:

- Brainstorm names that speak to your mission

- Select a name that is easy to spell and pronounce

- Choose an acronym for your organization at the same time if the name is longer

Check online with the state’s business office (the Secretary of State or state incorporation webpage) to see if your chosen name is available.

2. Find an Attorney or Professional to Help (If You Have a Budget)

If your budget allows, start by finding an attorney or professional organization experienced in starting nonprofit 501c3 organizations. They’ll guide you through each step, making getting your application accepted by the IRS less stressful. Many online resources and experts can assist you if you have a smaller budget.

3. File Articles of Incorporation with Your State

The next step in starting a nonprofit organization is to file papers called Articles of Incorporation with your state’s corporate office or Secretary of State. The Articles of Incorporation require basic information regarding your new nonprofit and function like a constitution governing the nonprofit corporation. The language needs to be very clear to be granted tax-exempt status.

Articles of Incorporation officially document your nonprofit name, address, nonprofit function, and the names of your chosen directors.

4. Apply for Federal and State Tax Exemptions

After you have filed the Articles of Incorporation, you are ready to submit a federal 501(c)(3) tax exemption application to the IRS. The IRS requires you to complete Package 1023, the Application for Recognition of Exemption. You will be exempt from paying taxes as a recognized 501(c)(3), and your donors can report donations to your organization.

Starting a nonprofit 501c3 in some states requires a separate application for a state tax exemption. Others only require that you file nonprofit articles of incorporation and have federal 501(c)(3) tax-exempt status. Check with your Secretary of State for your legal requirements.

5. Draft Nonprofit Bylaws for the New Nonprofit

Forming bylaws is an important step in starting a nonprofit 501c3. They contain rules and procedures for board meetings, decision-making, and elections of officers and directors. Initially, you may draft some bylaws. They are commonly adapted at the first board meeting.

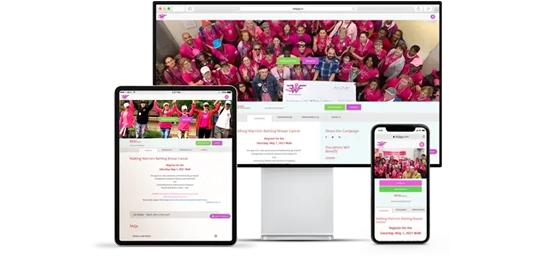

6. Establish a Nonprofit Website and Social Media Channels

Your nonprofit website will be key to sharing your mission with the world. You communicate to your supporters, donors, and volunteers – your heroes. Your homepage constantly changes and communicates fundraising events, live streams, stories, and photos. Social media accounts also allow you to connect easily with your supporters and build your base.

7. Select Your Nonprofit Board Members

When you start a charity organization, one of the most important decisions you’ll make is selecting your Board of Directors. Your nonprofit board members have an important job to do for your nonprofit:

- Determining the organization’s mission and aligning goals accordingly

- Strategic planning and support of your goals

- Financial planning and securing adequate financial resources for the organization to fulfill its mission

- Overseeing and cooperating with legal and ethical standards and norms

- Recruiting and training new and diverse board members

The IRS requires that nonprofit 501c3 organizations have at least three board members. Many organizations find value in adding additional board members.

8. Hold the First Board Meeting

At the first meeting of the board of directors, the directors take care of formalities such as adopting the bylaws, electing officers, and recording the receipt of federal and state tax exemptions. After the meeting is completed, the minutes of the meeting should be created and filed in the nonprofit’s records binder.

9. Apply for Necessary Licenses and Permits

Each state has different licenses and permits for nonprofits. Choosing the right ones and ensuring they are done properly is of the essence. While the forms required are not complex, it is helpful to let a professional assist you. This is especially true once you begin fundraising, as charitable solicitation registration is the law, and the requirements vary from state to state. Starting a nonprofit 501c3 with the official documents done correctly is worth a little extra time and supervision.

10. Start Fundraising

You’ve done it! You have officially established a 501c3 nonprofit organization. Now, to accomplish your mission, you’ll need funds. The best place to start is with your inner circle and current stakeholders. Ask your Board Members and others to make a monthly contribution. Establishing a monthly giving program will create a baseline of funding to cover basic costs.

Check out our free fundraising software platform to get started on the road to successful fundraising.

Donors Are Key to Starting a Successful Nonprofit

Fundraising for your new nonprofit will likely be important from the start. Starting a successful nonprofit is accomplished with a continual influx of new donors and volunteers. Here are some fundraising strategies to get started.

Find Public Speaking Opportunities

A great way to find and engage new donors is through speaking engagements. Approach universities, church meetings, Rotary and other civic clubs, for opportunities. Holding an open house at your new nonprofit is another great place to engage your community. Getting in front of an audience of potential volunteers and donors wins hearts and minds.

Create an Interesting Newsletter

To create a following of supporters and attract new donors, write engaging stories. You’ll want to write appealing content and make your newsletter interesting. Highlight heartfelt stories of your new beginnings. As the months pass, you’ll have stories of how you helped to change the world.

Thank donors and volunteers and showcase them each month. Your first donations make for great stories – speak loudly of them to inspire others to donate. A bi-weekly newsletter is best to keep folks engaged.

Follow Nonprofit SEO Best Practices

Maybe they’ve heard something about you, and maybe they haven’t, but people need to be able to find your organization online. Whether people are looking for your organization or simply seeking a cause or event to support, they are likely to do an online search. When was the last time you visited page three of Google? Invest time and resources in SEO for your nonprofit website if you want to succeed.

Apply for Grants

Many nonprofits benefit from grants, which are generally free money that does not need to be paid back. The government usually gives grants at the local, state, and federal levels, and many private and public foundations also offer nonprofit grants.

Peer-to-Peer and Crowdfunding Campaigns Can Grow Your Nonprofit

Another concrete way to find new donors and volunteers is through peer-to-peer events. People form an allegiance and give to nonprofits when their friends ask them to. Board members, volunteers, and staff reaching out to friends and family and asking them to participate in a crowdfunding event can expand your network and open up new partnerships. DoJiggy can help with free p2p software for donor-friendly fundraising campaigns.

Get Your Nonprofit Funded with Free Fundraising Websites by DoJiggy

Our free fundraising software lets supporters spread the word about your new nonprofit.