Campaigns made on our new virtual fundraising platform now have the functionality to support UK Gift Aid donations. Gift Aid provides a great opportunity for donors to increase the value of their donations to a charity. When this option is enabled on your campaign, donors will be able to indicate that they want their donation gift-aided.

Charities can access reports with the Gift Aid information in campaign management, helping your organisation readily claim Gift Aid with HM Revenue and Customs (HMRC).

What Is Gift Aid, and How Does It Work?

Gift Aid is a tax incentive that enables tax-effective giving to charities in the United Kingdom. Gift Aid applies to monetary and in-kind donations made by UK individuals only; there is no minimum donation limit to claim Gift Aid.

Gift Aid allows individuals who are subject to UK income tax to complete a simple declaration that they are a UK taxpayer. Any donations that the taxpayer makes to the charity after making a declaration are treated as being made after deduction of income tax (at the basic tax rate) and therefore, the charity can reclaim the basic income tax already paid on eligible donations.

This means that for UK charities, for every pound donated with Gift Aid, the charity will receive £1.25 in total with no additional cost to the donor.

Gift Aid Donation Eligibility

To be eligible to receive Gift Aid, charities must be officially registered with HMRC.

Next, donors must complete a Gift Aid declaration form which is good for donations made for up to four years. These eligibility forms can be created on your organisation’s website. A Gift Aid eligibility form confirms that a donor is a UK taxpayer and that their charitable donations do not exceed the amount of tax paid during the tax year. If a supporter pays less income tax and/or capital gains tax than the amount of Gift Aid claimed on all their donations in that tax year, it is the supporter’s responsibility to pay any difference.

Monetary and in-kind donations made by individuals are eligible for Gift Aid, when no goods or services were received in exchange for the donation. Therefore, certain donations are not eligible for Gift Aid:

- Donations made in return for goods or services, including raffle tickets, items bought in charity shops, or online auctions

- Fundraising event tickets

- Donations made by companies or organisations

Errors on Gift Aid claims can result in charities owing repayment to HMRC. We recommend working with an accountant to check your Gift Aid processes.

How Do I Enable Gift Aid on DoJiggy?

UK-based organizations can easily set up GiftAid functionality on any of their campaigns. This setting can be found in the Checkout Options of the Experience setup.

Enabling this option will show a new section in the checkout process for supporters to indicate that they would like to Gift Aid their donation. They will then be asked to provide any additional information that you need. This information submitted by supporters will be readily available to you in the reporting area to help you claim Gift Aid.

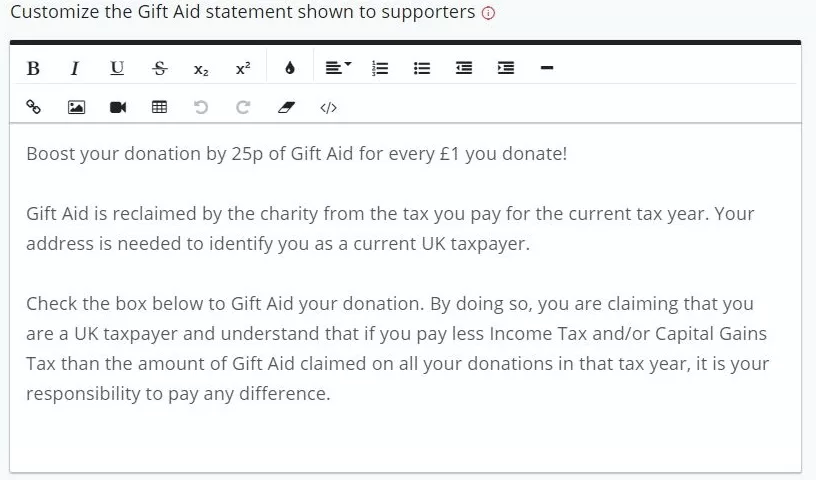

You will also customize your message to donors, asking them to Gift Aid. Our default message is:

Claiming Gift Aid

Keeping your records in order is key to correctly claiming Gift Aid. Please note that DoJiggy is not the Gift Aid agent for your charity. We will not submit Gift Aid claims to HMRC on your behalf, but we will provide the data you need to assist in your reporting process.

Ready to Boost Your Fundraising Efforts with Gift Aid?

![16 Best Fundraising Platforms for Nonprofits [2024] 16 Best Fundraising Platforms for Nonprofits [2024]](https://www.dojiggy.com/files/sites/164/2022/07/best-fundraising-platforms-for-organizations-1-425x264.webp)