Imagine a world where your nonprofit’s vision touches the hearts of millions, inspiring them to reach into their wallets and bring your projects to life. Nonprofit crowdfunding does just this, raising funds for a wide range of projects, causes, and business ventures.

So, what are the different types of crowdfunding, and how does peer-to-peer fundraising fit in? In this blog, we’ll help you understand the ins and outs of donation-based crowdfunding (including peer to peer), reward-based crowdfunding, debt-based crowdfunding, and equity-based crowdfunding.

What We’ll Cover

- Benefits of Crowdfunding for Nonprofits

- The 4 Main Types of Crowdfunding

- How Does Donation-Based Crowdfunding Work?

- How Does Reward-Based Crowdfunding Work for Nonprofits?

- Our Free Crowdfunding Platform Supports Nonprofit Donations and Rewards-Based Crowdfunding Campaigns

- How Does Debt-Based Crowdfunding Work?

- How Does Equity-Based Crowdfunding Work?

Benefits of Crowdfunding for Nonprofits

Crowdfunding has grown into an indispensable tool for nonprofits. Beyond just a fundraising strategy, it allows organizations to foster a sense of community, share their stories, and inspire action. The benefits of crowdfunding for nonprofits include the following:

- Global Reach: With the power of the internet, your nonprofit can connect with supporters worldwide, expanding your influence beyond local or regional boundaries.

- Storytelling: Crowdfunding campaigns are a powerful platform for storytelling, allowing you to share the who, what, and why of your nonprofit, building emotional connections with your audience.

- Market Testing: By launching a campaign, you can gauge public interest in your project or initiative before fully committing resources, effectively serving as a form of market testing.

- Social Proof: Successful crowdfunding campaigns create social proof, demonstrating public support and confidence in your organization and its mission.

- Supporter Engagement: Crowdfunding offers a unique way for supporters to engage directly with your cause. They’re not just donating; they’re participating in your mission and witnessing the impact of their contribution.

So now we’ve seen the benefits of crowdfunding, let’s dive into how each type of crowdfunding works.

The 4 Main Types of Crowdfunding

There are four different types of crowdfunding, each with its own purpose and benefits. Your group will want to understand and convey which crowdfunding type is needed in a given situation. We’ll cover each of these four crowdfunding strategies in more detail:

- Donation-based crowdfunding

- Reward-based crowdfunding

- Debt-based crowdfunding

- Equity-based crowdfunding

How Does Donation-Based Crowdfunding Work?

Let’s take a closer look at the most popular method of crowdfunding for nonprofits: donation-based crowdfunding.

The Concept

Donation crowdfunding is a funding model where:

- A nonprofit, individual, or project needs financial support.

- They set up a crowdfunding campaign and share it with potential donors.

- Supporters contribute donations to a cause without expecting a financial return.

- Peer-to-peer fundraising is a type of donation-based crowdfunding where individuals reach out to their network to find supporters for your cause.

Example

Here’s an example of donation-based crowdfunding.

The Nonprofit: ‘Feed the Future’ is a nonprofit aiming to tackle child hunger.

The Need: They require funds to launch a new initiative providing school meals.

The Solution: Feed the Future sets up a donation crowdfunding campaign and shares its mission.

The Supporters: Individuals moved by the cause donate funds to the campaign.

The Outcome: Donors feel fulfilled knowing they’ve contributed to a cause they believe in, and Feed the Future secures the funds needed for its initiative.

How Does Reward-Based Crowdfunding Work for Nonprofits?

Rewards-based crowdfunding is another popular type of crowdfunding, typically used to raise funds for a new startup or organization that offers a product or service.

The Concept

Reward crowdfunding for nonprofits involves:

- A nonprofit organization that requires funding for a particular project or cause.

- The organization sets up a crowdfunding campaign and offers rewards or perks to donors.

- Donors contribute financially and receive tokens of appreciation in return.

Example

Let’s consider this scenario for crowdfunding with rewards.

The Nonprofit: ‘Art for All’ is a nonprofit aiming to make art classes accessible to underprivileged children.

The Need: They need funds to purchase art supplies and hire additional instructors.

The Solution: Art for All launches a reward crowdfunding campaign, offering hand-made thank you cards from the children as a reward to donors.

The Donors: Supporters who are passionate about the cause donate to the campaign, excited by the prospect of receiving a heartfelt, personalized reward made by the organization’s beneficiaries.

The Outcome: Backers receive special thank-you cards, and Art for All gets the necessary funds to run their art classes.

Reward-based crowdfunding can be a powerful tool for nonprofits, offering a tangible way to express gratitude to donors and fostering a deeper connection between the donors and the cause they are supporting.

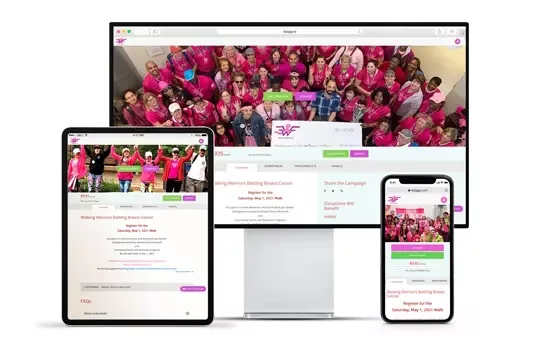

Our Free Crowdfunding Platform Supports Nonprofit Donations and Rewards-Based Crowdfunding Campaigns

How Does Debt-Based Crowdfunding Work?

Debt-based crowdfunding, also referred to as peer-to-peer lending or crowdlending, is a simple way for individuals, organizations, and businesses to raise vital funds when they need them. Kiva popularized this form of crowdfunding with its micro-loans to small businesses.

The Concept

Debt crowdfunding, or peer-to-peer lending, is a way for organizations to borrow money:

- A nonprofit organization needs a loan.

- Instead of a traditional bank, it turns to its crowd of supporters.

- Individuals lend money to the organization and receive interest payments in return.

Example

Consider this scenario for peer-to-peer lending.

The Nonprofit: ‘Community Revamp’ is a nonprofit organization working to refurbish community centers in underprivileged areas.

The Need: They need a loan to fund a new project.

The Solution: They decide to use debt crowdfunding to secure this loan.

The Lenders: Individuals who believe in the mission of Community Revamp lend money.

The Outcome: These individuals receive their money back with interest as Community Revamp successfully completes its project and repays the loan.

While debt-based crowdfunding is a less typical approach for nonprofits, it can be suitable for specific projects or situations where the nonprofit has a clear path to repay the loan.

How Does Equity-Based Crowdfunding Work?

Finally, equity crowdfunding may seem distant from the nonprofit world, but understanding it could open new possibilities for your organization.

The Concept

Equity crowdfunding is a funding model where:

- A startup or a company needs capital to grow.

- It offers shares to public investors.

- Investors buy these shares, effectively becoming part-owners of the company.

Example

Let’s illustrate equity-based crowdfunding with a simple example.

The Enterprise: Meet ‘Eco-Warriors,’ a social enterprise that creates eco-friendly alternatives to everyday products while empowering underprivileged communities.

The Need: To expand its operations, Eco-Warriors needs capital.

The Solution: They decide to launch an equity crowdfunding campaign and offer shares of their company to the public.

The Investors: Supporters who are passionate about the Eco-Warriors mission and see its potential for financial growth decide to invest.

The Outcome: In exchange for their investment, these supporters receive shares in Eco-Warriors. They are now part-owners and stand to benefit if Eco-Warriors turns profitable.

Why Should Nonprofits Care about Equity-Based Crowdfunding?

Even though nonprofits might not offer shares or seek equity investments, understanding how equity crowdfunding works can be beneficial as it broadens your understanding of fundraising strategies and allows you to identify partnership opportunities with social enterprises that use this model.

Last Thoughts on Crowdfunding

Crowdfunding holds immense potential for nonprofits. Understanding these diverse crowdfunding types empowers nonprofits to choose the method best suited to their needs and foster a deeper connection with supporters.

![16 Best Fundraising Platforms for Nonprofits [2024] 16 Best Fundraising Platforms for Nonprofits [2024]](https://www.dojiggy.com/files/sites/164/2022/07/best-fundraising-platforms-for-organizations-1-425x264.webp)